tennessee auto sales tax calculator davidson county

You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07. The nashville tennessee general sales tax rate is 7.

Tennessee Property Tax How To Calculate Nashville Property Tax

This includes the rates on the state county city and special.

. The calculator will show you the total sales tax amount as well as the. The 2018 United States Supreme Court decision in South Dakota v. The Davidson County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Davidson County local sales taxesThe local sales tax consists of a 225.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Blountville TN 37617. 7 State Tax on the sale price minus the trade-in.

Purchases in excess of 1600 an. The davidson county sales tax rate is. Local Sales Tax is 225 of the first 1600.

The Davidson County sales tax rate is. 10000 subtract Total vehicle sales price 25300. Sr Special Sales Tax Rate.

The average cumulative sales tax rate in Nashville Tennessee is 928 with a range that spans from 925 to 975. PLUS 15 to 275 Local Tax on the first 1600 of the purchase. For example lets say that you want to purchase a new car for 60000 you.

Heres the formula from the Tennessee Car Tax Calculator. Lynchburg TN 37352. S Tennessee State Sales Tax Rate 7 c County Sales Tax Rate.

L Local Sales Tax Rate. You can use our Tennessee Sales Tax Calculator to look up sales tax rates in Tennessee by address zip code. This amount is never to exceed 3600.

Sales tax in Davidson County Tennessee is currently 925. The Tennessee state sales tax rate is currently. State Sales Tax is 7 of purchase price less total value of trade in.

All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise. 35000 Documentation fee. Customer located in Davidson County.

Vehicle Sales Tax Calculator. Tennessee has a 7 sales tax and Davidson County collects an. The use tax is the counterpart to the sales tax.

You can calculate Sales Tax manually using the formula or use the. Vehicle Sales Tax Calculator. The sales tax rate for Davidson County was updated for the 2020 tax year this is the current sales tax rate we are using in the.

Depending on the zipcode the sales tax rate of nashville may vary from 7 to 925. 300 Add Trade-in allowance.

Car Loan Calculator Tennessee Dealer Consumer Calculator

Tennessee County Clerk Registration Renewals

Detailed How To Search Property Assessor Of Nashville Davidson County Tn

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Davidson County Tn Sales Tax Rate Sales Taxes By County November 2022

How Much Sales Tax For A Car In Tennessee

2972 Melvin Rd Hermitage Tn 37076 Mls 2437247 Redfin

How Much Sales Tax For A Car In Tennessee

Davidson County Newest Homes For Sale Uploaded Daily

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Small Business Guide Truic

Vivian Wilhoite Davidsonco Assessor Of Property Nshpropassessor Twitter

Tennessee Income Tax Calculator Smartasset

Tennessee County Clerk Registration Renewals

Are Your Property Taxes Too High Nashville Business Journal

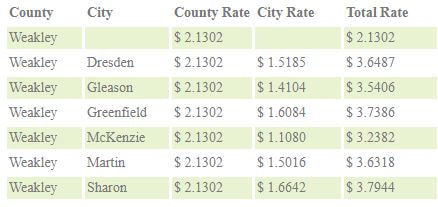

Weakley County Assessor Of Property Tax Rates

Berry Hill Tennessee Tn 37204 37211 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tax Rates Calculator Property Assessor Of Nashville Davidson County Tn